SecondMarket™

Powered By Nasdaq Private Market

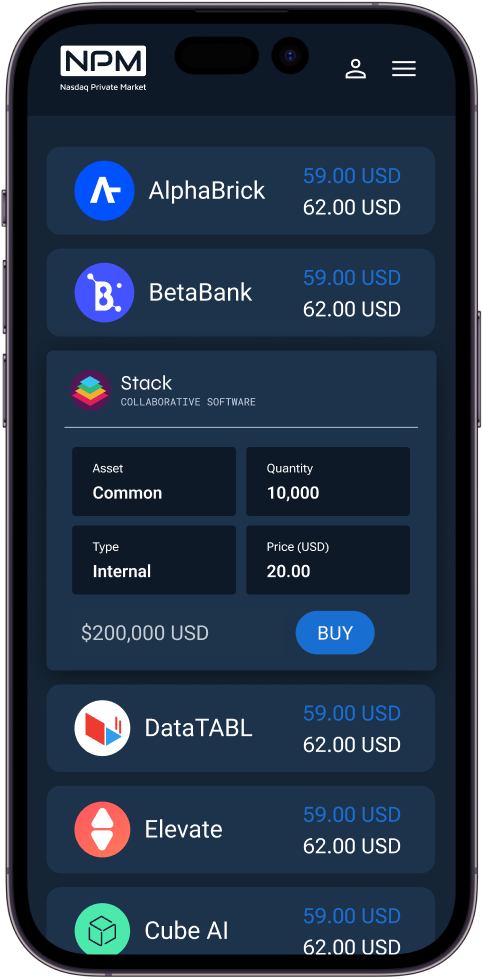

An institutional-grade trading platform to buy and sell blocks of private company stock.

Buy + Sell Stockeast

Software to Scale the Private Market

Transact with Confidence via One Global Platform

Whether you are a private market expert or new to secondary liquidity, let our product specialists help you navigate the secondary market and execute block trades.

Via our intuitive technology and experienced team, we guide you throughout the onboarding, execution, and settlement process making it as seamless as possible.

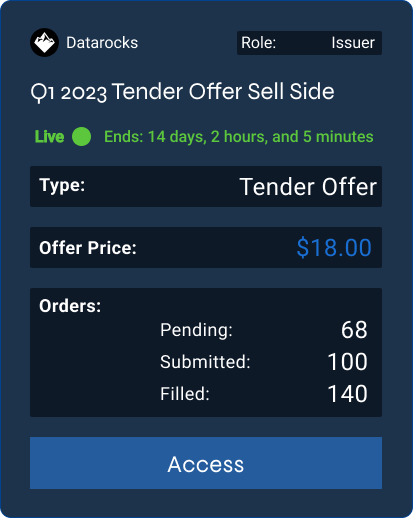

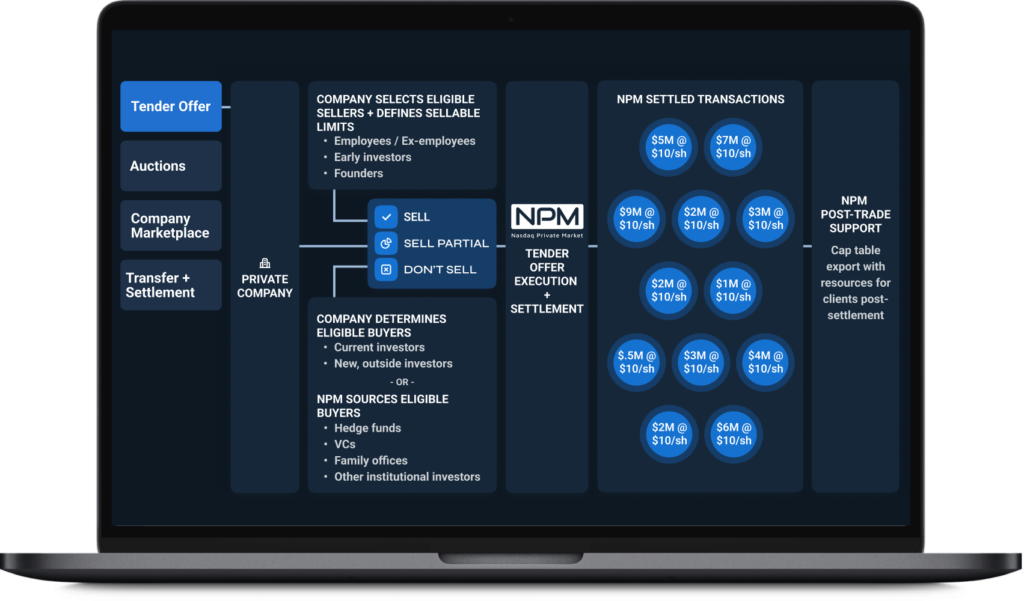

Our Trading Capabilities

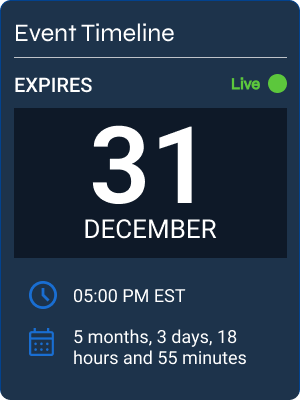

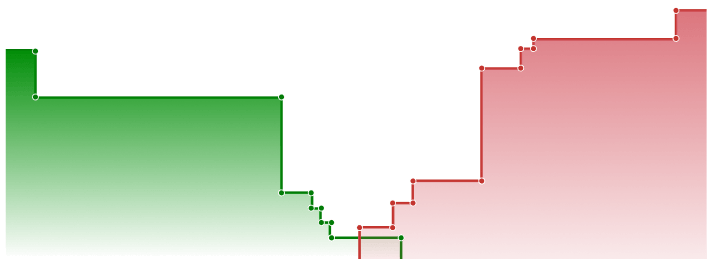

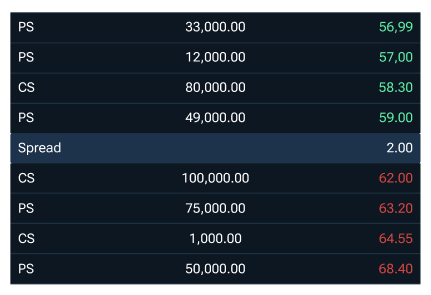

Buy + Sell StockeastAlternative Trading System

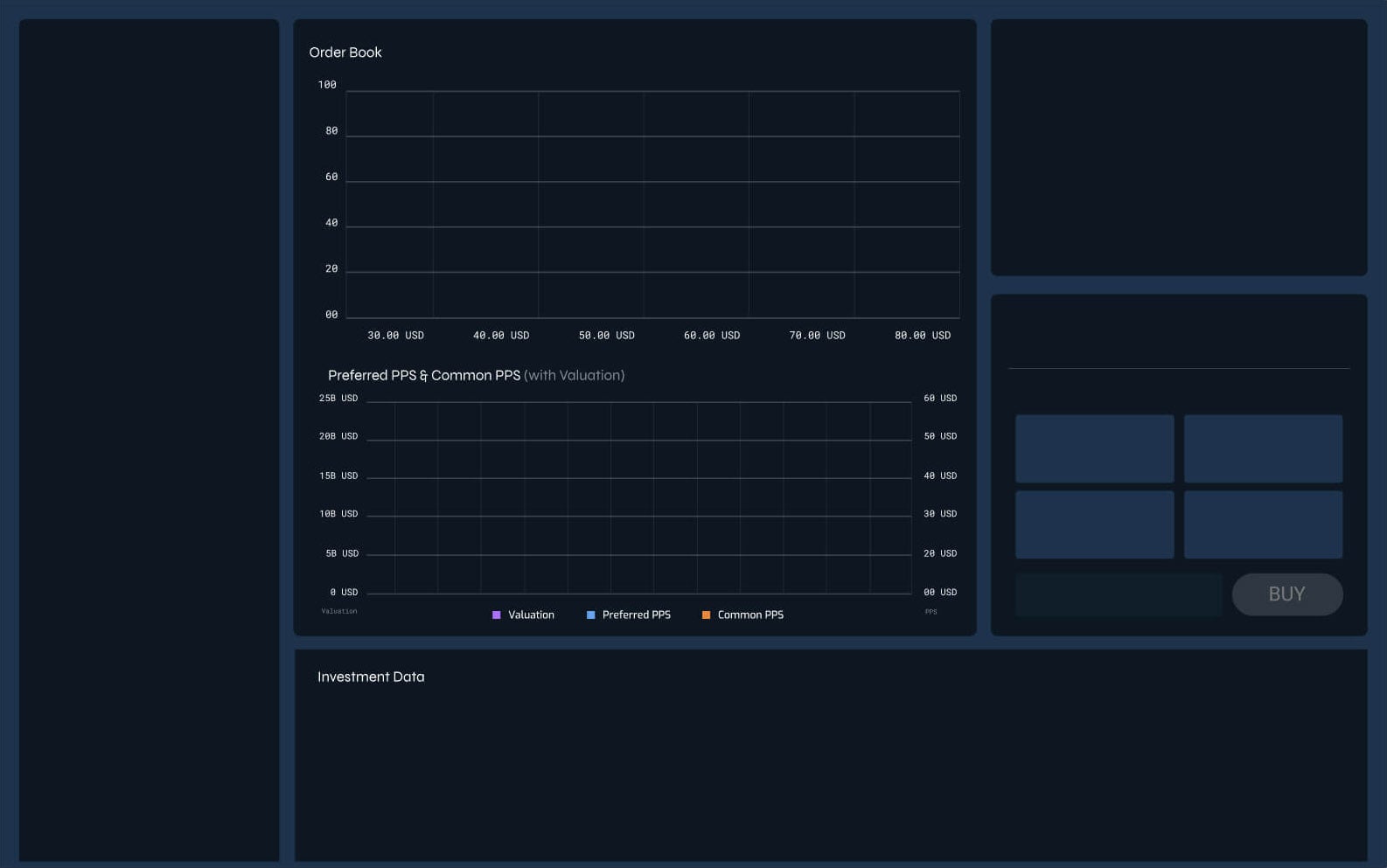

Order book, OMS, and crossing network for vetted members to trade private company shares.

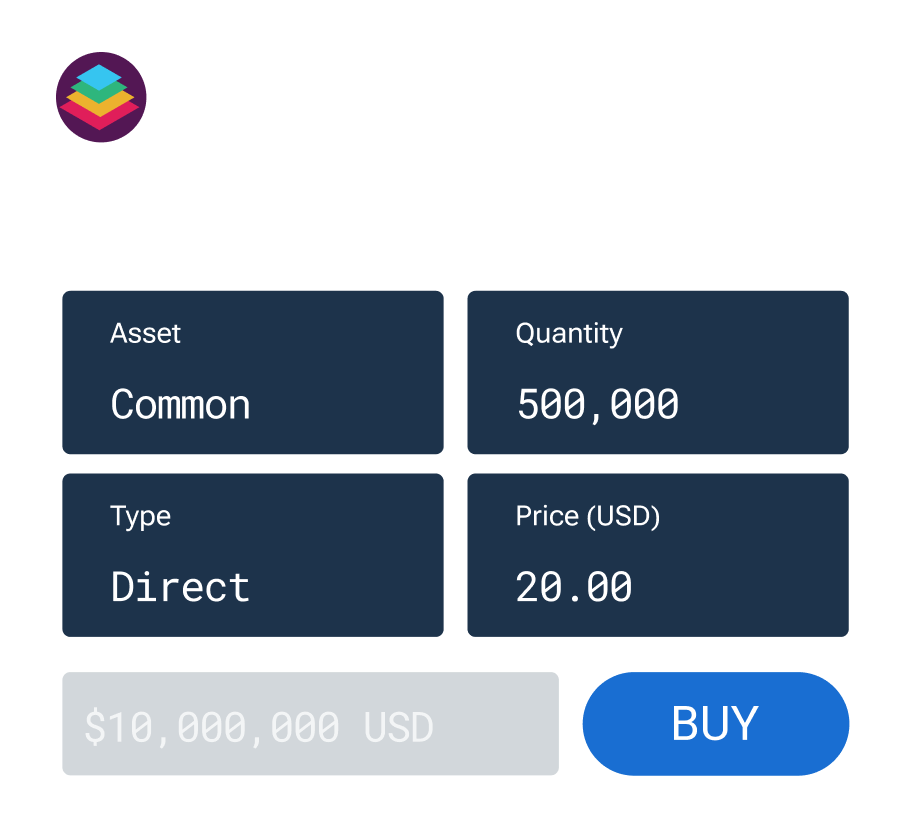

Customizable Trading Platform

Our end-to-end execution tools enable clients to set broker and investor workstations to meet their needs.

Negotiation Tracker

Simplify trade management with a centralized dashboard for accepting, countering, or rejecting offers from a wide network of participants.

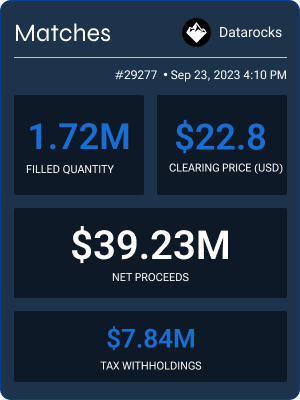

Settlement

Streamline share transfers in one unified workstation, enhancing efficiency by structuring trade data to simplify the settlement process.

Onboarding

Get personalized support to get started and access SecondMarketTM features and functionality, unlocking your secure private company marketplace.

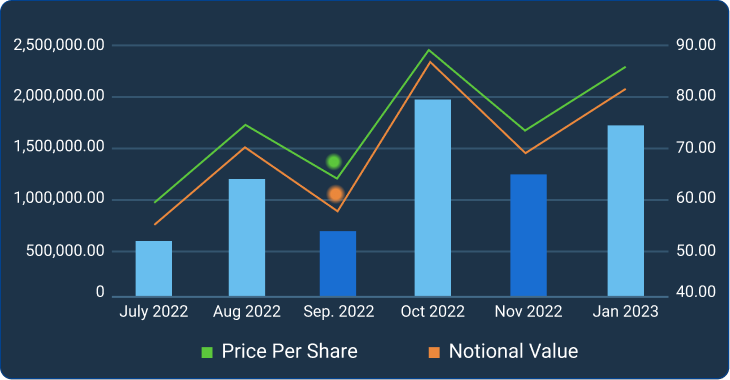

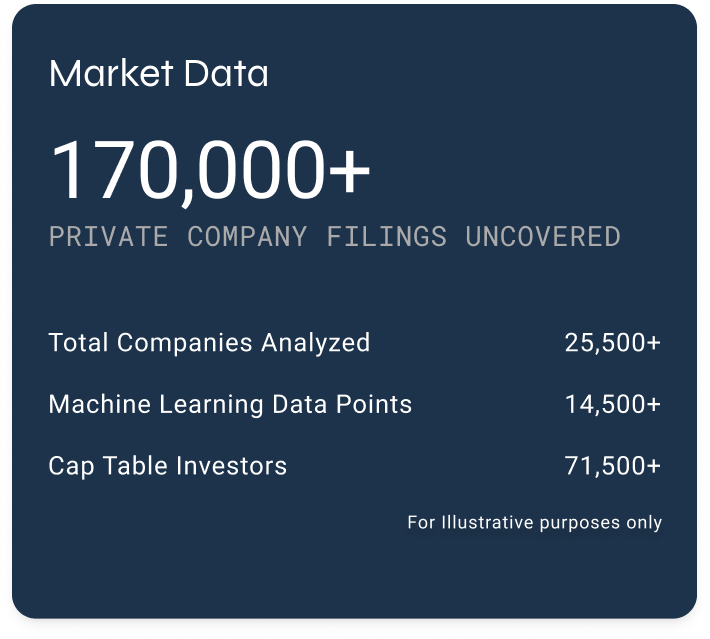

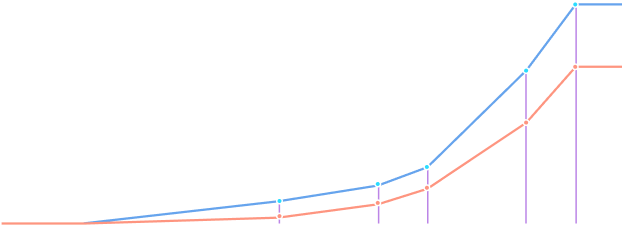

Market Data

Embedded proprietary finanacial products, data room, and private company ticker functionality to inform trading decisions.

A Decade of Private Market Experience

Expertise

Private market pioneers and practitioners helping employees, shareholders, investors, banks, and brokers trade with proficiency in a new asset class.

Premier Global Network

Connect to Unicorn and high-value private company shareholders, active institutional investors, brokers, and banks worldwide.

Easy-to-Use Technology

Our frictionless platform has been built to the requirements of traders and investors with direct feedback from banks, brokers, and institutional investors.

Total Transaction Value

0

-

Total Company-Sponsored Programs

0

-

Number of Eligible Program Participants

0

-

Private Companies' Data Tracked

0

-

Onboarded Institutional Investors

0

-

Total Number of Unicorn Clients

0

Data as of January 2024